Tax Havens and Harmful Tax Practices Transfer Pricing News Tag. Positioning Corporate Malaysia for a sustainable future.

Malaysia Tax Revenue Of Gdp 1991 2022 Ceic Data

6 rows Corporate - Taxes on corporate income.

. Malaysia Non-Residents Income Tax Tables in 2019. 0 0 or 15 10. Malaysia Corporate Tax Rate was 24 in 2022.

As of 2019 the standard corporate tax rate in Malaysia is 24 on taxable income. An individual is considered tax resident if heshe is in Malaysia for 182 days or more in a calendar year. Last reviewed - 13 June 2022.

Resident company with a paid-up capital of RM 25. On the First 5000. Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019.

Cukai Makmur will be imposed on companies excluding companies which enjoy the 17 reduced tax rate above. Capital gains tax CGT rates. On the First 5000.

2010 2011 2012 2013 2014 2015 2016 2017. 0 0 0. Mutual Agreement Procedure MAP Multilateral Instrument MLI Non-Resident.

The standard corporate income tax rate in Malaysia is 24. Other corporate tax rates include the following. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA.

Advance Pricing Arrangement. On the First 5000 Next 15000. Headline corporate capital gains tax rate Generally gains on capital assets are not subject.

For both resident and. Resident companies with a paid-up capital not exceeding. Corporate Tax The common corporate tax rate in Malaysia is 25.

Corporate tax rates for years 2013 2019. Malaysia Corporate Tax Rates. Total tax rate for medium sized businesses 2018 Statista Guide to taxes in Malaysia brackets-incentives - ASEAN UP Related.

Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800. Corporate tax rate 2019 malaysia - Japan Corporate. Corporate companies are taxed at the rate of 24.

20182019 Malaysian Tax Booklet 22 Rates of tax 1. 27 rows Malaysia Corporate Tax Rate History. Posted on April 8 2019 By TP News No comments.

Malaysia Non-Residents Income Tax Tables in 2019. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in. Tax RM 0 - 5000.

Rate TaxRM A. On the First 5000.

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Tax And Fiscal Policies After The Covid 19 Crisis

Malaysia Tax Revenue 1980 2022 Ceic Data

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Pros Cons Of Corporate Tax Rate Cut Yadnya Investment Academy

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Why It Matters In Paying Taxes Doing Business World Bank Group

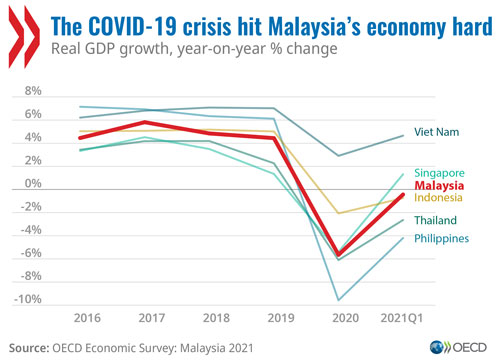

Malaysia Further Reforms To Boost Business Dynamism Would Strengthen The Recovery From Covid 19 Says Oecd

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Taxplanning So You Want To Start Your Own Business The Edge Markets

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Why It Matters In Paying Taxes Doing Business World Bank Group

Cukai Pendapatan How To File Income Tax In Malaysia

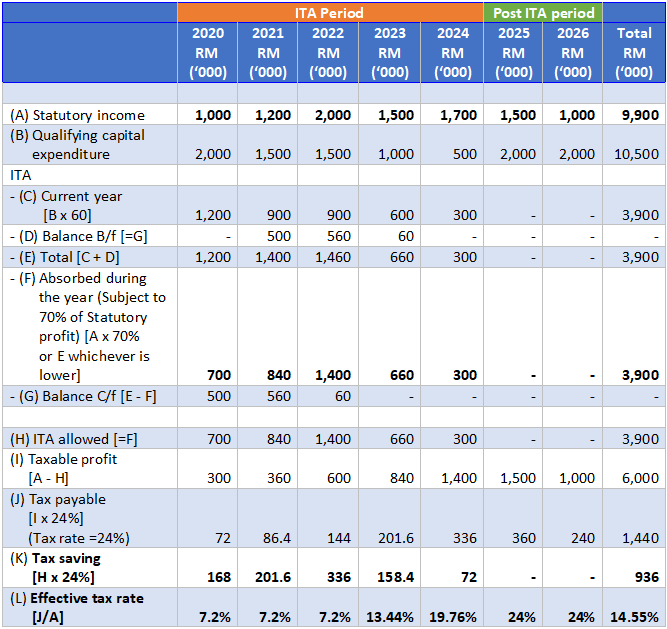

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday